EU Introduces MiCA for Crypto Regulation

The European Union has made headlines by passing pioneering legislation aimed at regulating the previously unregulated cryptocurrency market.

This comprehensive framework, known as the Markets in Crypto Assets law, would bring cryptocurrency markets under the oversight of government agencies.

MiCA will go into force once it obtains formal approval from member states, ushering in a new age of cryptocurrency regulation in the EU.

Understanding MiCA: Crypto-Asset Regulation Markets

MiCA is a proposed rule by the European Commission to create a legal framework for crypto-assets in the European Union.

Its objectives include fostering innovation, protecting consumers’ and investors’ interests, and ensuring financial stability and market integrity. MiCA includes utility tokens, stablecoins, asset-referenced tokens, and e-money tokens among its crypto-assets.

Crypto-Asset Categories Inclusion and Exclusion

Certain types of crypto-assets, such as asset-referenced tokens and electronic money tokens, will be covered under MiCA.

ARTs are crypto-assets whose value is derived from legal tender fiat currency, commodities, other crypto-assets, or a combination of these. EMTs, on the other hand, are crypto-assets backed by a single legal tender fiat currency.

MiCA does not include decentralised finance or non-fungible coins, as defined by the European Central Bank. DeFi refers to financial services that use automated protocols rather than centralised middlemen, whereas NFTs represent one-of-a-kind digital assets like paintings, movies, or tweets.

Exclusion of Central Bank Digital Currencies

It is important to note that MiCA does not cover CBDCs as well. CBDCs are excluded from this regulation.

The European Union: An Overview

The European Union, consisting of 27 member countries, is a political and economic alliance known for promoting democratic values and fostering strong trade relationships.

The EU, headquartered in Brussels, Belgium, emerged after World War II with the aim of enhancing cooperation across Europe.

Implications of MiCA: A Safer and More Transparent Crypto Environment

This groundbreaking move by the EU signifies a proactive step towards regulating the cryptocurrency market and ensuring a safer and more transparent environment for participants.

The implementation of MiCA is expected to have far-reaching implications for the crypto industry within the European Union and potentially influence global regulatory approaches to digital assets.

Summary

The Markets in Crypto Assets law marks a key milestone as the European Union takes the lead in developing bitcoin legislation. The EU intends to stimulate innovation, protect consumers, and maintain market stability by building a comprehensive legislative framework.

With the implementation of MiCA, the European Union sets an example for other jurisdictions and takes a step towards creating a safer and more transparent crypto ecosystem.

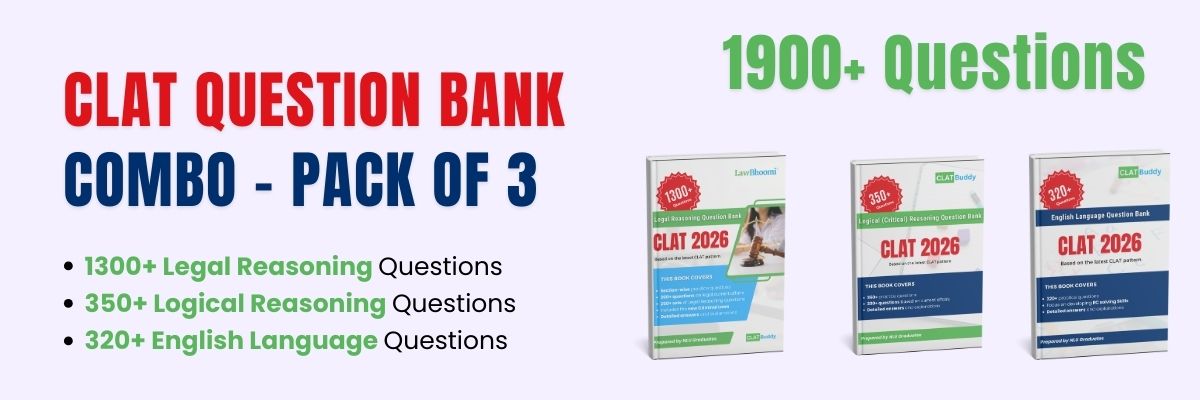

Calling all law aspirants!

Are you exhausted from constantly searching for study materials and question banks? Worry not!

With over 15,000 students already engaged, you definitely don't want to be left out.

Become a member of the most vibrant law aspirants community out there!

It’s FREE! Hurry!

Join our WhatsApp Groups (Click Here) and Telegram Channel (Click Here) today, and receive instant notifications.