City Savings Banks

Urban co-operative banks play a crucial role in the financial landscape by serving as pillars of economic stability for urban communities. These banks, often founded with the primary goal of supporting the financial needs of local populations, have a rich history and continue to evolve in the modern era.

Urban co-operative banks, often referred to as UCBs, are financial institutions that are primarily focused on providing banking services to urban and semi-urban areas. These banks are usually set up as co-operative societies, with a focus on the welfare of their members and the communities they serve.

Historical Perspective

The roots of urban co-operative banks can be traced back to the early 20th century in India when the first UCB, the Baroda Peoples Co-operative Bank, was established in 1902.

Since then, the UCB sector has grown substantially, with numerous banks sprouting across the country. The cooperative movement aimed to uplift the economic conditions of individuals and communities, especially in urban areas.

Regulatory Framework

Urban co-operative banks are subject to a regulatory framework that oversees their operations. In India, the Reserve Bank of India (RBI) and the National Bank for Agriculture and Rural Development (NABARD) play a pivotal role in regulating and supervising these banks.

Functions and Services

Urban co-operative banks offer a range of banking services, including savings and current accounts, fixed deposits, and loans. They cater to the financial needs of both individuals and small businesses, making them an essential part of urban economies.

Advantages of Urban Co-operative Banks

The advantages of banking with UCBs include better interest rates on deposits, easier access to credit, and a more customer-centric approach. These banks also tend to have a deep understanding of the local community’s financial needs, which is reflected in their services.

Challenges Faced

Urban co-operative banks face their share of challenges, including stiff competition from commercial banks, governance issues, and the need to adopt modern technology to stay relevant. Addressing these challenges is crucial for their sustained growth.

Recent Developments

The UCB sector has witnessed significant changes, particularly in the adoption of technology. Many urban cooperative banks now offer online banking services, mobile apps, and digital payment solutions. This transition has brought convenience to customers and increased the banks’ reach.

Case Studies

Several UCBs have made remarkable contributions to their communities. For example, the Kerala-based Muthoot Fincorp Ltd has provided financial solutions to rural and semi-urban areas, contributing to the financial well-being of the population.

Role in Financial Inclusion

Urban co-operative banks have played a significant role in promoting financial inclusion. They have reached out to areas where commercial banks hesitate to operate, bringing banking services to the underprivileged and unbanked.

Risks and Security Measures

Like any financial institution, UCBs face risks, including credit risk, market risk, and operational risk. To mitigate these risks, they employ various security measures, including robust risk management systems and adherence to regulatory guidelines.

Future Prospects

The future of urban co-operative banks appears promising, as they continue to adapt and evolve. These banks are likely to embrace technology even more and expand their reach to serve a broader customer base effectively.

Comparison with Commercial Banks

While both urban cooperative banks and commercial banks offer banking services, they have distinct differences. UCBs have a community-oriented approach and are more accessible to local customers, while commercial banks often focus on profitability.

Supporting Legislation

Urban cooperative banks operate under specific legal frameworks, including the Banking Regulation Act, of 1949, and the Co-operative Societies Act, of 1912. These legislations ensure their proper functioning and governance.

Summary

Urban co-operative banks continue to be significant players in the financial sector, providing personalized and community-centric services. As they embrace technology and innovate to meet the changing needs of urban populations, their role in the banking industry will likely expand.

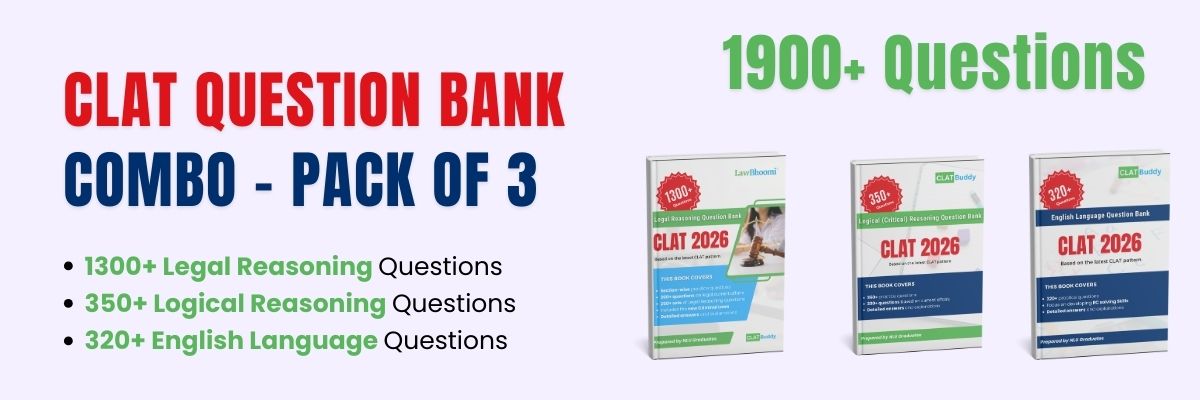

Calling all law aspirants!

Are you exhausted from constantly searching for study materials and question banks? Worry not!

With over 15,000 students already engaged, you definitely don't want to be left out.

Become a member of the most vibrant law aspirants community out there!

It’s FREE! Hurry!

Join our WhatsApp Groups (Click Here) and Telegram Channel (Click Here) today, and receive instant notifications.