European Union’s Carbon Border Tax

The European Union intends to implement the Carbon Border Adjustment Mechanism in October 2023. This technique intends to levy a carbon tax on imported items made with non-green or ecologically unsustainable technology.

It is crucial to stress, however, that the adoption will be gradual. CBAM will convert to a 20-35% tax on January 1st, 2026, however this will only apply to a restricted amount of products entering the EU.

As the world grapples with the grave issues of climate change and environmental degradation, the European Union has taken substantial measures to address these concerns and encourage sustainable practices.

Understanding the Carbon Border Tax

The Carbon Border Tax, also known as CBAM, is a policy suggested by the European Union to address the issue of carbon leakage.

Carbon leakage is the phenomenon in which corporations transfer their manufacturing to countries with laxer environmental rules, resulting in a rise in global carbon emissions without successfully resolving the issue.

Objectives of the Carbon Border Tax

The fundamental goal of the Carbon Border Tax is to level the playing field for European Union companies while promoting global sustainability.

The EU intends to push both local and foreign manufacturers to adopt cleaner and more sustainable manufacturing techniques by placing a fee on imported items with a large carbon footprint.

Implementation and Mechanism

The Carbon Border Tax requires multiple processes to correctly quantify and account for the carbon emissions buried in imported commodities.

The European Union intends to set up a thorough monitoring system that will trace the carbon footprint of items from the time they are manufactured until they reach the EU market.

The CBAM will first concentrate on industries with a high risk of carbon leakage, such as steel, cement, aluminium, and power generation.

Impact on Industries

The Carbon Border Tax will have far-reaching consequences for sectors both inside and outside the European Union. Domestic industries who have already adopted sustainable practices will gain from a more fair playing field, since their overseas counterparts will bear the same carbon-related expenses.

This encourages enterprises to invest in clean technology and ecologically responsible practices, resulting in long-term sustainability and competitiveness.The Carbon Border Tax poses both obstacles and opportunity for industries outside the EU.

Global Implications

The European Union’s Carbon Border Tax sets a significant precedent for global climate action. By taxing carbon-intensive imports, the EU not only protects its own industries, but also pushes governments throughout the world to prioritise sustainability.

This decision encourages other countries to tighten their climate policy, invest in renewable energy, and minimise their carbon footprint. The Carbon Border Tax serves as a stimulus for worldwide collaborative efforts to mitigate climate change and build a greener future.

Summary

The European Union’s Carbon Border Tax is a game-changing strategy that mixes economic competitiveness with environmental goals. The EU intends to lead the worldwide battle against climate change by tackling the issue of carbon leakage and supporting cleaner industrial practices.

The Carbon Border Tax’s implementation will definitely have a substantial influence on industries both inside and outside the EU, boosting the adoption of sustainable practices and strengthening global collaboration.

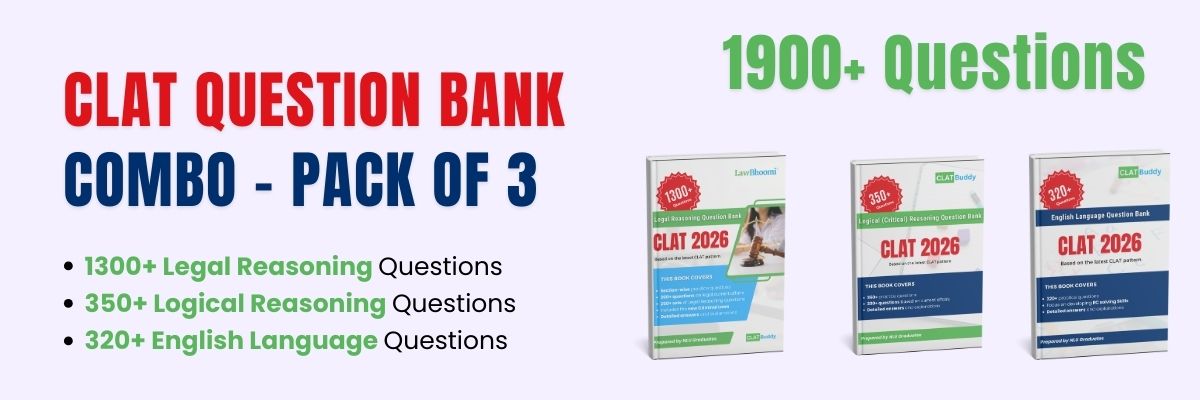

Calling all law aspirants!

Are you exhausted from constantly searching for study materials and question banks? Worry not!

With over 15,000 students already engaged, you definitely don't want to be left out.

Become a member of the most vibrant law aspirants community out there!

It’s FREE! Hurry!

Join our WhatsApp Groups (Click Here) and Telegram Channel (Click Here) today, and receive instant notifications.