RBI’s Digital Money

The financial world is evolving rapidly, and one of the most significant changes in recent times has been the introduction of Central Bank Digital Currencies (CBDCs). The Reserve Bank of India (RBI) is not far behind in this digital revolution, and in this article, we will delve into the intriguing world of RBI’s digital currency.

The concept of a central bank-backed digital currency has gained momentum worldwide. RBI, India’s central bank, is considering the introduction of its own digital currency, often referred to as the RBI’s Central Bank Digital Currency or CBDC.

What is CBDC?

A Central Bank Digital Currency is a digital form of a country’s official currency. It’s issued, regulated, and controlled by the central bank, making it different from cryptocurrencies like Bitcoin. The primary purpose of CBDC is to offer a secure and stable medium of exchange.

The Need for a Digital Currency

The shift towards digital currencies is driven by several factors. In an increasingly digitized world, cash transactions are on the decline. CBDCs aim to provide a digital alternative that ensures the same level of trust and security as physical cash.

RBI’s Initiative and Motivation

The RBI’s exploration of CBDC stems from a desire to stay at the forefront of technological advancements and to provide financial services that are more efficient and accessible. The RBI aims to leverage CBDC to enhance financial inclusion and promote secure transactions.

How Does CBDC Work?

CBDC operates on a blockchain or similar technology, ensuring transparency and security. Transactions are recorded in a digital ledger and can be tracked in real time, reducing the risk of fraud and counterfeit currency.

Advantages of RBI’s CBDC

- Enhanced Security: CBDCs come with robust security measures that reduce the risk of fraud and money laundering.

- Financial Inclusion: CBDC can reach remote areas, making financial services accessible to all.

- Efficiency: Transactions are faster, reducing settlement times.

- Reduced Costs: CBDC can lower transaction costs for both businesses and individuals.

Challenges and Concerns

While the introduction of CBDC offers numerous advantages, there are challenges and concerns to address. These include data privacy, cyber threats, and the impact on traditional banking systems.

Global Perspectives on CBDC

Several countries are exploring CBDCs, each with unique approaches. Understanding these global perspectives can provide valuable insights into the potential of RBI’s CBDC.

Security Measures in Place

Security is paramount in the world of digital currencies. RBI is implementing advanced security measures to protect the integrity of the CBDC.

Potential Impact on Traditional Banking

The introduction of CBDC can reshape the traditional banking sector. We’ll discuss the potential impact and how traditional banks are responding to this change.

CBDC vs. Cryptocurrencies

CBDCs and cryptocurrencies have distinct differences. We’ll highlight these differences and explore their coexistence in the financial landscape.

Regulatory Framework

A well-defined regulatory framework is essential for the successful implementation of CBDC. We’ll discuss how RBI plans to regulate and oversee its digital currency.

Future Possibilities

As technology advances, the possibilities with CBDC are limitless. We’ll delve into the potential future developments and innovations in the world of digital currency.

Summary

RBI’s digital currency is a significant leap forward in India’s financial landscape. The introduction of CBDC promises increased security, financial inclusion, and efficiency. As the world moves towards a digital future, RBI’s CBDC is poised to play a pivotal role in shaping the financial ecosystem.

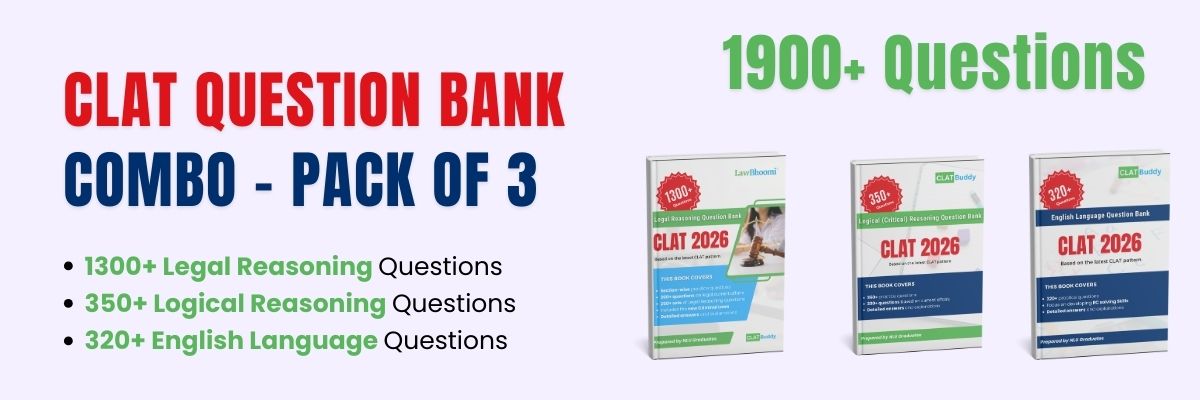

Calling all law aspirants!

Are you exhausted from constantly searching for study materials and question banks? Worry not!

With over 15,000 students already engaged, you definitely don't want to be left out.

Become a member of the most vibrant law aspirants community out there!

It’s FREE! Hurry!

Join our WhatsApp Groups (Click Here) and Telegram Channel (Click Here) today, and receive instant notifications.